Introduction

If you are running a business, dealing with pay stubs is an essential part of your business operations, as pay stubs allow your employees to keep track of all of their important financial details from employment, like their income, taxes, and pension contributions, and they also allow you to keep payroll records effectively and accurately. Handling paychecks and paystubs manually may be a headache if you do not have access to professional paystub production software, and it can consume much too much of your time. This means you will need to be familiar with your local labor regulations, maintain track of your employer identification number, calculate your employees’ hours worked, and correctly manage all of your deductions. Fortunately, there are many paystubs creator software options available on the market.

What is a pay stub?

A paystub is the most frequent term for the report that an employee receives after they get a paycheck. That is, it is a breakdown of all of their salary for that pay period, explaining what each figure represents and where each piece of money comes from. Paystubs can also be referred to as paycheck stubs, pay stubs, or pay slips.

Different employers will utilise different information on their pay stubs, but some data will nearly always be the same regardless of how they compile paystub information. Most employers are generally expected to include certain basic information: the employee’s name, social security number, address, and any other important identifying information.

In most situations, the software used to create paystub information will also include pertinent company information, such as the employer’s business address and phone number.

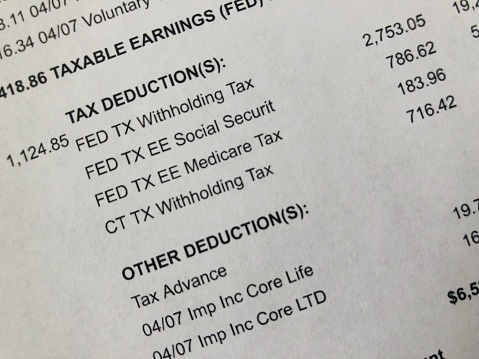

A pay stub will additionally show the employee’s pay rate for the relevant time period, as well as the date period covered by the pay slip. It will also provide two key figures: the gross pay (the amount earned before any withholdings such as taxes are deducted) and the net pay (which is the actual take home pay the employee will receive). You should also anticipate a fully itemised list of all applicable withholdings.

What are Paystub Generators?

Paystub generators are a type of software that has dramatically transformed the payroll industry in recent years, giving a significantly faster and more inexpensive solution for smaller businesses to manage their payrolls without the need for a convoluted collaboration with a payroll provider. Online paystub generators have greatly simplified the process of manual payroll management and given a beneficial alternative to the previously restricted possibilities.

Many small businesses and startups lack the capacity to engage with specialist payroll processing organisations, which means they must handle all of the tedious labor of payroll administration manually. Businesses with small workforces frequently use manual payroll administration to save money. However, it is still a time-consuming and labor-intensive procedure for most employees due to all of the data that must be computed manually. Once set up, a paystub generator takes care of everything, simplifying the process and allowing you to simply enter the necessary information and obtain a fully comprehensive and useable pay stub as a result.

Conclusion

Payslips creator software is an important part of smooth operations, and it can make your life far easier if used effectively. No small business should be without high-quality payroll management tools!